Are Home Prices Too High?

There is an advantage to squatting in the same niche of the market for years, even decades. And that is that your brain will sometimes make connections on its own – connections that would not have occurred to your conscious mind, even if you were studying a particular question in what you thought was depth.

A case in point: yesterday I was re-writing an old piece I had on the value of real estate as a hedge, to make it a permanent page on my blog and a “How-To” on the Inflation Guy app. At one point, I’m illustrating how a homeowner might look at the “breakeven inflation” of homeownership, and my brain asked “I wonder how this has changed over time?”

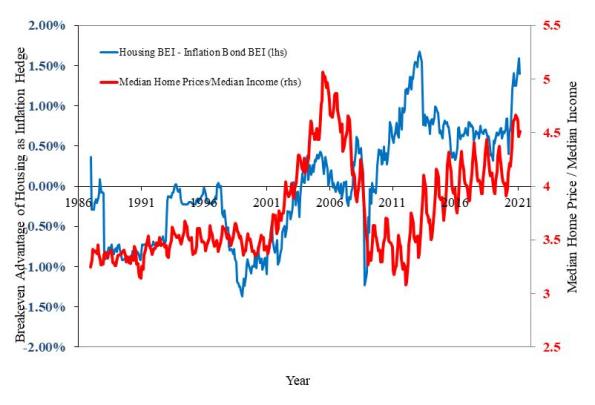

So, I went back in the Shiller dataset and I calculated it. To save you time reading the other article, the basic notion is that a homeowner breaks even when the value of the home rises enough to cover the after-tax cost of interest, property taxes, and insurance. In what follows, I ignore taxes and insurance because those vary tremendously by locality, while interest does not. But you can assume that the “breakeven inflation” line for housing ought to be at least a little higher. In the chart below, I calculate the breakeven inflation assuming that mortgage rates are roughly equal to the long Treasury rate (which isn’t an awful assumption if there’s some upward slope to the yield curve, since the duration of a 30-year mortgage is a lot less than the duration of a 30-year Treasury), that a homeowner finances 80% of the purchase, pays taxes at the top marginal rate, and can fully deduct the amount of mortgage interest. I have a time series of the top marginal rate, but don’t have a good series for “normal down payment,” so this illustration could be more accurate if someone had those data. The series for inflation-linked bonds is the Enduring Investments imputed real yield series prior to 1997 (discussed in more detail here, but better and more realistic than other real yield research series). Here then are the breakeven inflation rates for bonds and homes.

It makes perfect sense that these should look similar. In both cases, the long bond rate plays an important role, because in both cases you are “borrowing” at the fixed rate to invest in something inflation-sensitive.

The intuition behind the relationship between the two lines makes sense as well. Prior to the administration of Ronald Wilson Reagan, the top income tax rate was 70% or above. Consequently, the value of the tax sheltering aspect of the mortgage interest made it much easier to break even on the housing investment than to invest in inflation bonds (had they existed). That’s why the red line is so much lower than the blue line, prior to 1982 (when the top marginal rate was cut to 50%) and why the lines converged further in 1986 or so (the top marginal rate dropped to 39% in 1987). The red line even moves above the blue line, indicating that it was becoming harder to break even owning a home, when the top rate dropped to 28%-31% for 1988-1992. Pretty cool, huh?

Now, this just looks at the amount of (housing) inflation of the purchase price of the home needed to break even. But the probability of realizing that level of housing inflation depends, of course, on (a) the overall level of inflation itself and (b) the level of home prices relative to some notion of fair value. This is similar to the way we look at probable equity returns: what earnings or dividends do we expect to receive (which is related to nominal economic growth), and what is the starting valuation level of equities (since we expect multiples to mean-revert over time). That brings me back to a chart that I have previously found disturbing, and that’s the relationship between median household income and median home prices. For decades, the median home price was about 3.4x median household income. Leading up to the housing bubble, that ballooned to over 5x…and we are back to about 5x now.

That’s the second part of the question, then – what is the starting valuation of housing? The answer right now is, it’s quite high. So are we in another housing bubble? To answer that, let’s compare the two pictures here. In the key chart below, the red line is the home price/income line from the chart above (and plotted on the right scale) while the blue line is the difference between the breakeven inflation for housing versus breakeven inflation in the bond market.

In 2006, the breakeven values were similar but home prices were very high, which means that you were better off taking the bird-in-the-hand of inflation bonds and not buying a home at those high prices. But today, the question is much more mixed. Yes, you are paying a high price for a home today; however, you also don’t need much inflation to break even. If home prices rise 1.5% less than general inflation, you will be indifferent between owning real estate and owning an inflation bond. Which means that, unlike in 2006-7, you aren’t betting on home prices continue to outpace inflation. It’s a closer call.

I can come up with a more quantitative answer than this, but my gut feeling is that home prices are somewhat rich, but not nearly as much so as in 2006-07, and not as rich as I had previously assumed. Moreover, while a home buyer today is clearly exposed to an increase in interest rates (which doesn’t affect the cash flow of the owner, but affects the value the home has to a future buyer), a home buyer will benefit from additional “tax shelter value” if income tax rates rise (as long as mortgage interest remains tax deductible!). And folks, I don’t know if taxes are going up, but that’s the direction I’d place my bets.

How does the increase in standard deduction affect this? A whole lot of people who used to benefit from deducting mortgage interest and RE taxes now find that their itemized deductions no longer quite get to the standard deduction. Clearly changes the incentives.

Good question. I think to do this “right” would involve a lot more modeling of the tax structure. But that’s usually lots harder than modeling all of the financial parts!