Archive

Summary of My Post-CPI Tweets (October 2018)

Below is a summary of my post-CPI tweets. You can (and should!) follow me @inflation_guyPV and get this in real time, by going to PremoSocial. Or, sign up for email updates to my occasional articles here. Investors with interests in this area be sure to stop by Enduring Investments or Enduring Intellectual Properties. Plus…buy my book about money and inflation. The title of the book is What’s Wrong with Money? The Biggest Bubble of All; order from Amazon here.

- Only 20 minutes to CPI!

- This month, we are looking for something of a correction to last month’s terribly weak and surprising core CPI (0.08% m/m).

- Recall that last month, Apparel plunged -1.6% m/m – which seems at odds with a world of higher landed costs due to tariffs.

- The only way that would make sense is if BLS were backing out the tariffs from the retail prices, but this isn’t like sales tax – no good way to disentangle tariffs since some products have ’em and some don’t.

- So Apparel prices are due for a bounce. That’s well-understood out there in inflation land I think.

- The apparel plunge was the driving force pushing core goods to -0.2% y/y when it had gotten all the way up to 0.0% y/y the prior month. It’s hard to get a lot of inflation without core goods being positive!

- Other parts of core goods remain perky, such as Used Cars and Trucks. Probably some further gains due there.

- The core services component was also soft last month, as OER softened slightly (but it has a big weight) and medical care declined.

- I’m starting to get less confident that Medical Care will have a big upswing because of work I’m doing in pharma inflation. But at the same time, the y/y looks like it may have fallen too far too fast. And I don’t think doctors’ services +0.8% y/y makes a lot of sense.

- All in all, the odds I think favor a solid 0.2% or above. This would cause y/y core to reaccelerate from 2.19% back to the 2.3% range b/c we’re dropping off an 0.13% from last Sept. To get a 2.4% print on core, we’d need 0.29% or better m/m, which is a stretch.

- …but not out of the question if last month’s surprises are totally reversed.

- The bottom line I am really watching is core-ex-shelter, which has been rising and is the key to the next leg higher in inflation. Housing won’t carry the water.

- We’re down to about 12 minutes here before the number and one thing I want to add: more than recent CPIs this is likely a pretty important number for the stock market. Climbing CPI –> higher rates;stocks aren’t handling that well right now. A soft CPI is really good for stocks.

- Ordinarily equities ignore CPI, but maybe not today.

- One last point to make is that even with the weak month last month, core CPI is up at a 2% annualized pace over the last quarter. Median is at 2.5% annualized over the last 3 months. So we’re not talking deflation here.

- Another very soft CPI. 0.116% on core. As that is roughly in line with what’s dropping off from a year ago, y/y core stays about the same at 2.2%.

- First glance is that Apparel bounced but OER was weaker. If that’s true then this isn’t as weak as it looks.

- 2.17% y/y on core, down from 2.18%, so as I said basically unch.

- No doubt however that this is a huge relief to stocks. Even if it is stronger than it looks on the surface, it’ll help take the Fed off the relative boil (not like they’ve been crazy hawkish, just by recent standards)!

- Incredibly, the subcomponents are AGAIN being slow-rolled by Bloomberg and this time looks like that’s because the BLS is being slow releasing the data. Crazy. Someone get them a new laptop.

- Yayy! Finally getting data. So Apparel was +0.93% m/m, which raised y/y from -1.41% to -0.55%. Partial retracement and makes more sense. Only 3% of the CPI basket but a big move makes some difference.

- Ah, here’s the thing. There was a MASSIVE decline in CPI-Used Cars of -2.99% m/m. That’s completely absurd. It puts y/y to -1.47% from +1.25% in that category, pushes core goods from -0.2% to -0.3%, and dampened overall CPI.

- But it makes NO SENSE. Private surveys of used vehicle prices are still rising at around 4% per year. This is complete nonsense.

- Here’s the chart. Used cars had been closing the gap. Again, this is nonsense. And it’s a big enough category to matter some.

- Moving on…OER was only 0.18% m/m, pushing the y/y to 3.27% from 3.33%. Primary Rents were 0.24% m/m, 3.63% y/y up from 3.61%.

- The OER modest deceleration isn’t terribly problematic although home prices are still rising quickly enough that I wouldn’t expect it to get much slower than it currently is. Primary Rents still rising, which puts the cherry on that point.

- Lodging Away from Home plunged -1.01% m/mm, so the y/y dropped to 0.57% from 2.34%. Large moves in that index aren’t terribly unusual, so this isn’t an “AirBnB effect.” Will probably be reversed next month.

- Back of the envelope by the way (and I know I’m refusing to let cars go again) is that Used Cars cost about 0.075% on core CPI. Put that back and your 0.116% becomes 0.191% m/m…right on expectations.

- Medical Care remains weak. Pharma -0.19% m/m, but rises to 1.17% y/y from 0.77% because of base effects. Doctors’ Services 0.26% m/m, with y/y up to 0.46%..not exactly running away. And Hospital Services softened to 3.79% y/y from 4.17%.

- BUT, because of those base effects, Medical Care overall rose to 1.73% y/y vs 1.54%.

- doctors’ services:

- Forgot to update this chart, last 12 core CPI prints. Although, as I said, this one is bogus.

- Core ex-housing, even with the cars nonsense (he really just won’t let it go, will he??), accelerated to 1.38% from 1.34%. That’s still below the 1.5% hit in July, but we’d be just about there without those cars you know.

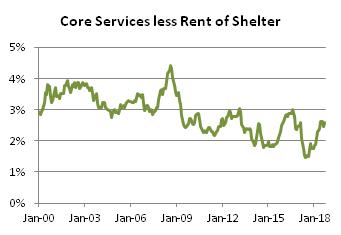

- Here’s core ex-shelter. If you think the Fed is “going crazy” tightening, it’s because of this. Right about in the middle of the last two decades’ range. But I think it’s heading up.

- All this talk about used vehicles…I should note that New Vehicles rose to 0.47% from 0.30% y/y. Placidly approaching the upper end of the range.

- For something completely different, there was a rise in Cable & Satellite television service this month after a long slide. That’s 1.5% of the overall CPI…about 3/4 the weight of used cars!

- So let’s see…m/m largest declines were …hey! Used Cars and Trucks #1, Footwear #2, and Lodging Away from Home #3. We’ve discussed two of those. Biggest gainers were Mens/Boys Apparel (retracement), Car & Truck Rental (splutter), and another couple of apparel categories.

- Now, here’s why I prefer Median CPI. It’s totally for months like this. Median this month ought to be around 0.22%, meaning y/y should be almost exactly unch at 2.77%. As always, my Median is an estimate, but it should be pretty good this month.

- And that’s the REAL story – inflation continues to motor along at about 2.8%, when measured using an index that isn’t perverted by inaccurate surveys of cars.

- So here’s the summary. Great number for stocks, because they don’t care about the details. It’s not really a soft number, though – all one category. Core goods at -0.3% really ought to be at 0.3% or 0.4% (see chart), and assuming it does converge there we’ll see core CPI resume.

- But you don’t really need Core CPI because Median is already telling you what you need to know: inflation is in the high 2s. The rebound from last year is over, and last few numbers have been basically flat around 2.8%.

- Same story in this chart, showing the weight of categories inflating faster than 3%. It’s pretty steady and has been for a while. This is why we were able to ‘look through’ the 2017 slowdown in core CPI. The middle of the distribution was stable/rising slightly.

- The key question for the next leg, up or down, is what happens to core goods. Housing, as I wrote recently, is not about to accelerate or decelerate in a MAJOR way. The next leg will have to come from other categories catching up.

- With a following wind from clearly-rising wages and “protection” from offshore price competition, this seems very probable. Ergo, I expect Median to be over 3% in the next quarter or two. We’re not talking hyperinflation, but it’s going to keep creeping higher.

- People sometimes ask me, “don’t you think the Fed knows how to look through the CPI to see what’s really going on?” The answer is no, I do not. I’ve yet to find a Fed person who gets very down and dirty with the data in a way that’s illuminating (as opposed to a wonky model).

- OK, to wrap this up let’s look at the four pieces charts and tell the story (for new followers: these four pieces are each around 1/4…actually 0.2-0.33…of overall CPI). First, Food & Energy.

- Next, Core Goods. Already discussed. This should be, and will be, higher.

- Core Services less Rent of Shelter. A lot of this is Medical Care Services and I’m less bullish on that than I have been. It would help the bull-inflation story to see this above 3%, but I’m just not sure it can get there in short order.

- Finally, Rent of Shelter. It’s probably a bit below where it should be, but as I recently wrote it’s not going to be doing anything dramatic here for a while.

- That’s all for today. I just want to conclude by saying that it is a NATIONAL EMBARRASSMENT that we can’t accurately measure the behavior of used car prices. Not to put too fine a point on it.

Update and Summary on Housing Inflation

It’s inflation week, and so an excellent time to sign up to follow my live CPI tweets on my “premium” channel by signing up at PremoSocial. Membership also gets you access to my daily and weekly chart packages, to which I tweet a link daily on that channel. (Consider it – for only $10/month!)

It’s worth turning for a bit to look at the housing market. Shelter is a large part of what consumers spend money on, and therefore a large part of the CPI. It also happens that primary rents (if you rent your dwelling) and “Owners’ Equivalent Rent” or OER tend to be some of the slowest-moving pieces of the CPI. I’ve said many times that if you can get the direction of OER right, it’s very hard to be extremely wrong on the direction of core inflation.

Recently, there’s been some softening in home sales, and so in some quarters there has been an alarm raised that OER is about to start softening and therefore core inflation has peaked. My purpose in this article is to examine that evidence with an eye that is a bit more studied on these matters.

I think that often, economists tend to see patterns in the data when those patterns are congruent with what their models suggest should be happening. For example, it is reasonable to think that high home prices, coupled with rising mortgage rates, ought to slow home sales. There’s certainly evidence that changes in yields affects refinancing activity, as the chart below (source: Bloomberg) relating the Mortgage Bankers’ Association refi index to 10-year yields shows. The recent rise in yields (I’ve shown Treasuries, but mortgage rates move similarly) has depressed refinancing activity – and this makes sense, since fewer mortgages are profitable to refinance at these rates.

Alas, this relationship doesn’t hold very well when it comes to purchase data. Far more important to a home purchaser are current incomes and job prospects, both of which remain relatively strong for now. This next chart shows 10 year yields against the MBA “Purchase” index. At best, interest rates are a secondary or tertiary effect. This makes sense because the decision to refinance a house is a financing decision; the decision to buy a house in the first place is an investing decision.

Nevertheless, there has recently been some softening in purchasing activity of new homes. This next chart shows the seasonally-adjusted rate of existing home sales. I can see the softening, but I’m not sure it looks like it’s a very big deal yet. This is where, though, economists’ models might cause one to say that this looks like it’s rolling over because higher interest rates and lower affordability are dampening demand. Maybe. But this might also be noise especially considering we don’t see any softening in the purchase data. It might be that there’s less home-hopping (maybe because more people have secure jobs, there’s less migration?) or perhaps there’s less activity from the pure financial buyer (pension fund, e.g.) who is paying cash. Or, it could be noise.

Now, one of the reasons that people are sounding an alarm about housing might be that equities of home builders have recently swooned. The chart below shows the S&P Homebuilders SPDR ETF (Ticker: XHB), which has been declining rather sharply of late. Weak homebuilders, weak homebuilding, right? Perhaps. But lumber prices also recently doubled and then halved so there could be some volatility on costs as well. In any event, I’m extremely reluctant to attribute dramatic economic significance, not to mention prescience, to a collection of stocks run by equity monkeys.

I think the picture of home sales and home building is a typical late-cycle picture. That shouldn’t be surprising – we’re late in the cycle, even if there are some people who believe that the expansion will still be going strong in 2020. I’m not one of those people, although I hope I’m wrong. There is definitely some softening in activity indicators. But we’re talking here about pricing indicators. How do those look in housing and rents?

The chart below is the Case-Shiller 20-city composite, y/y. I’ve definitely read commentaries recently saying that this is a sign that housing inflation is rolling over.

The problem is that the Case-Shiller survey is smoothed, lagged, and revised. Moreover, it typically has much more volatility than we have seen in the last few years. The chart below is longer-term. I don’t know that I’d read a great deal into the recent weakening. Even if it is a true reading of a slowdown in pricing, it’s a pretty small effect. My own study suggests about a 10% pass-through to rents, with an 18-month lag. So, even if you want to get alarmed, you have a year and a half to do it.

I’m not really convinced, in case you couldn’t tell, that home prices are about to plunge even though I think they’re high. For one thing, the inventory of homes available for sale remains very low (a regression of properly lagged-and-seasonally-adjusted home inventories against the change in CPI shelter suggests that the current level of inventories is consistent with a 3.6% rise in Shelter CPI between August 2019 and August 2020. Currently, Shelter CPI is at 3.39%).

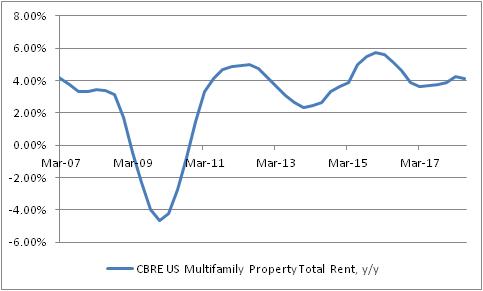

A more direct effect on Primary Rents and OER is from actual rental inflation, rather than indirectly through home prices. And here the information is again pretty ho-hum. The chart below is of CBRE apartment rents, y/y percentage change. Rents have slowed from 2015-16, but they’re still well above core inflation.

There have been some anecdotal reports of cooling rentals in hot or dense markets, but so far these are mostly anecdotes. Rental prices bear some watching, of course – especially since they pass through into CPI much more quickly than changes in home prices do.

Now, here’s a cautionary note about housing in general. I am most assuredly not a bull on real home prices and I think that they’ll probably underperform CPI going forward. And here’s the reason why. For many years, the relationship between home prices and incomes was very stable. Starting in 2000, home prices began to rise sharply faster than incomes, culminating in what we now know was a pretty ugly bubble. The chart below shows that bubble, and the return to the traditional relationship between home prices and incomes…and a renewed rise in that ratio. I am not saying that home prices are as bubbly now as they were in 2005. Indeed, the easy availability of credit these days makes it plausible that the equilibrium ratio is higher than the 3.4x of the 1970s, 80s, and 90s. The caveat, of course, is that this is true only if there has been a permanent easing in the availability of credit…and as the Fed is currently starting to slowly drain excess reserves, this is less clear. So, this is the warning sign and one good reason to keep a careful eye on home prices going forward.

Adding it all up, I don’t think there’s very persuasive evidence that we are about to see a meaningful deceleration in rental inflation. But just as I’m not persuaded that rents are about to decelerate markedly, I don’t see a great chance of a strong further acceleration (and our model is strikingly boring at present, as the chart below – source Enduring Intellectual Properties – illustrates).

Ergo, core inflation (and more importantly, median), to accelerate much further, needs to see a broadening of pressures from beyond merely rent. And we’re starting to see some signs of that in core goods, and a faint whisper in other quarters. Rents are not likely to be the driving force for the next leg higher in inflation. But at the same time, we haven’t yet seen very much evidence that rents are about to collapse. Home prices are too high, relative to incomes. They’re probably higher partly because of optimism about incomes, though, and if wages validate that optimism then home prices may not be due for as bruising a correction this time. Wages are clearly accelerating, so the jury is out on that point.

I think the overall conclusion therefore is that a fair forecast for rents and OER in the CPI still calls for stability for a while. If you’re hoping for inflation to decelerate soon, you ought look elsewhere.

Again, don’t forget to sign up at PremoSocial to get access to my CPI-day updates!