Summary of My Post-CPI Tweets (May 2020)

Below is a summary of my post-CPI tweets. You can (and should!) follow me @inflation_guy. Or, sign up for email updates to my occasional articles here. Investors, issuers and risk managers with interests in this area be sure to stop by Enduring Investments!

- Once again CPI day, and unlike last month where expectations were very low, it seems people think they have a firmer grasp of inflation this month. Ha!

- I suppose that’s relative, but while I think there will be some interesting stories today I wouldn’t read much into the near-term data. Some things we know will be happening just aren’t happening yet.

- Some examples include hotels, food away from home, rent of residence, medical care…all of these have serious upward pressures going forward, but not clear today.

- I’ll talk about these as we go today. The consensus forecast for core is -0.2%, dropping y/y core to 1.7% from 2.1%. Last April – so sweet, so long ago – was +0.198% on core so ordinarily we’d be expecting a small y/y acceleration today.

- But remember that last month, median inflation was pretty much normal. All of the movement in core was in lodging away from home, airfares, and apparel.

- I don’t know about apparel, but I doubt the other two have fallen as far this month. Surveys of used cars, another typical volatility source, have plunged though. Usually takes a couple months for that to come into the CPI, but with a big move like that, it might.

- On the other hand, prices for medical care were virtually ignored in the survey for last month’s release. If they start surveying those more ambitiously, that’s going to be additive. No question in the medium-term, medical care prices are going up.

- Rents will be very interesting. So, if someone skips a rent payment how the BLS treats it depends on whether the landlord expects to collect it eventually, some of it, or none of it.

- Rent-skipping isn’t yet unusually prevalent, and the threat that Congress could declare a rent holiday will mean that NEW rents are definitely going to be higher (this is a new risk for a landlord). Remember it’s rents that drive housing inflation, not home prices.

- Neither effect is likely appearing yet, but be careful of that number today. In fact, as I said up top, be careful of ALL of the numbers today!

- In the medium-term, inflation is lots more likely than deflation because there is much more money out there chasing fewer goods and services (20% y/y rise in M2, better than 50% annualized q/q). But today?

- And while no one will be surprised with a low number today, almost everyone would be shocked with a high number. But with a lot of volatility, a wider range of outcomes in BOTH directions becomes possible.

- In other words, HUGE error bars on today’s number, which SHOULD mean we take it with a grain of salt and wait for a few more numbers. Markets aren’t good with that approach. OK, that’s it for the walk-up. Hold onto your hats folks. May get bumpy.

- Core CPI fell -0.448%, meaning that it was very close to -0.5% m/m. The y/y fell to 1.44%. The chart looks like a lot of the other charts we’re seeing these days. But of course devil will be in the details.

- Core goods -0.9% y/y from -0.2%; core services 2.2% from 2.8%.

- CPI for used cars and trucks, coming off +0.82% last month, turned a -0.39% this month. That’s not super surprising. I suspect going forward that rental fleets will shrink (meaning more used cars) since most cars are rented from airports.

- Lodging Away from Home again plunged, -7.1% after -6.8% last month. That’s a little surprising. In my own personal anecdotal observation, hotel prices in some places went up last month, although to be fair that’s forward. TODAY’S hotel prices are still being discounted.

- However Primary rents were +0.20% after +0.30% last month. Y/Y slid to 3.49% from 3.67%. Owners’ Equivalent Rent was +0.17% vs 0.26% last month; y/y fell to 3.07% from 3.22%.

- I would not expect any serious decline in rents going forward. It’s housing stock vs number of households, and if we’re trying to spread out that means MORE households if anything. Also, as noted earlier I expect landlords to raise rents to recapture ‘jubilee risk.’

- Apparel was again down hard, -4.7% m/m. That’s not surprising to me. Transportation down -5.9% m/m, again no real surprise with gasoline. But Food & Beverages higher, up 1.40% m/m. That’s not surprising at all, if you’ve been buying groceries!

- Still some oddness in Medical Care. Pharma was -0.13% m/m, down to +0.78% y/y from +1.30% last month. Doctors’ Services -0.08%. Both of those make little sense to me. But hospital services +0.50% m/m, pushing y/y to 5.21% from 4.37%. That part makes perfect sense!

- Hospital Services Y/Y. Expect that one to keep going up. Overall, of the 8 major subsectors only Food & Energy, Medical Care, and Education/Communication were up m/m.

- Core ex-housing fell to +0.6% y/y, vs +1.45% last month. That’s the lowest since…well, just 2017. The four-pieces chart is going to be interesting. As I keep saying though, the real story is in 2-3 months once things have settled and there’s actual transactions again.

- Little pause here because some of the BLS series aren’t updated. I was looking at the -100% fall in Leased Cars and Trucks…and the BLS simply didn’t report a figure for that. Which is odd.

- …doesn’t look like a widespread problem so we’ll continue. A quick look forward at Median – there’s going to be more of an effect this month but going to be up by roughly +0.15% depending on where the regional housing indices fall.

- That will drop y/y median to 2.70% or so from 2.80%. You’ll see when we look at the distribution later, this is still largely a left-tail event. The middle of the distribution is shrugging slightly lower. Again, it’s early.

- Biggest core category decliners: Car and Truck Rental, Public Transportation, Motor Vehicle Insurance, Lodging Away from Home, Motor Vehicle Fees (sensing a trend?) and some Apparel subcategories.

- Only gainer above 10% annualized in core was Miscellaneous Personal Goods. But in food: Fresh fruits/veggies, Dairy, Other Food at Home, Processed Fruits/Veggies, Cereals/baking products, Nonalcoholic beverages, Meats/poultry/fish/eggs.

- Gosh, I didn’t mention airfares, -12.4% m/m, -24.3% y/y. Some of that is jet fuel pass through. But it’s also definitely not going to last. Fewer seats and more inelastic travelers (business will be first ones back on planes) will mean lots higher ticket prices.

- The airfares thing is a good thought experiment. Airlines have narrow margins. Now they take out middle seats. What happens to the fares they MUST charge? Gotta go up, a lot. Not this month though!

- I’ll take a moment for that reminder – people tend to confuse price and quantity effects here, which is one reason everyone expects massive deflation. There is a massive drop in consumption, but that doesn’t mean a massive drop in prices.

- Indeed, if it means that the marginal price-elastic buyer in each market is exiting long-term, it makes prices more likely to rise than to fall going forward. Producers only cut prices IF cutting prices is likely to induce more buyers. Today, they won’t.

- 10-year breakevens are roughly unchanged from before the number. If anything, slightly higher. I think that’s telling – they’re already pricing in so little inflation that it’s getting hard to surprise them lower.

- 10y CPI swaps, vs median CPI. Little disconnect.

- Little delay from updating this chart. OER dropped to the lowest growth rate in a few years. But it’s not out of line with underlying fundamentals.

- To be fair, underlying fundamentals take a while to work through housing, but lots of other places we’ve seen sudden moves. The only sudden move we have to be wary of is in rents if Congress declares a rent holiday.

- Under BLS collection procedures, if rent isn’t collected but landlord expects to collect in the future, it goes in normally. If landlord expects a fraction, that is taken into effect. If landlord doesn’t expect to collect, then zero.

- …which means that if Congress said “in June, no one needs to pay rent,” you’d get a zero, massive decline in rents…followed by a massive increase the next time they paid. That would totally muck up CPI altogether, and I would hope they would do some intervention pricing.

- So that’s a major wildcard. To say nothing of the huge effect it would have on the economy. Let’s hope Congress leaves it to individual landlords to work it out with tenants, or at worst there’s a Rental Protection Program where the taxpayers pay the rent instead of the tenant.

- OK time for four-pieces charts. For those new to this, these four pieces add up to the CPI and they’re all between 20% and 33% of the CPI.

- Piece 1: Food and Energy. Actually could have been worse. Energy down huge, Food up huge (+1.5% m/m). But this is the volatile part. Interesting for a change as energy is reversing!

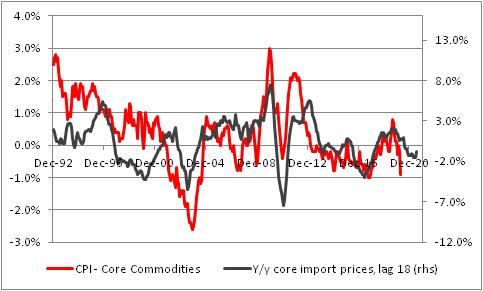

- Piece 2, core goods. We went off script here. But partly, this is because the medicinal drugs component is lagging what intuition tells us it should be doing.

- I said offscript for core goods. Here’s the model. We were expecting to be back around 0% over the next year, but not -1%.

- Piece 3, core services less rent of shelter. This was in the process of moving higher before the virus. Medical Care pieces will keep going higher but airfares e.g. are under serious pressure. Again, I think that’s temporary.

- Piece 4: rent of shelter. The most-stable piece; this would be alarming except that a whole lot of it is lodging away from home. I’ve already showed you OER. It has slowed, but it will take a collapse in home prices to get core deflation in the US. Doesn’t seem imminent.

- Last two charts. First one shows the distribution of price changes. Most of what is happening in CPI right now is really big moves way out to the left. That’s why Median is declining slowly but Core is dropping sharply. It’s the tails.

- And another way to look at the same thing, the weight of categories that are inflating above 3% per year. Still close to half. MOST prices aren’t falling and many aren’t even slowing. Some, indeed, are rising. This does not look like a deflationary outcome looming.

- Overall summary – much softer figure than last month, but still pretty concentrated in the things we knew would be weak. A few minor surprises. But for us to get a real deflationary break, another big shoe needs to drop.

- With money supply soaring and supply chains creaking, any return to normal economic activity is going to result in bidding for scarce supplies with plentiful money. You already see that in food, the one thing it’s easy to buy right now. That’s the dynamic to fear when we reopen.

- And, lastly. I’ve made the point many times recently: inflation hedges are priced so that if you believe in deflation you should STILL bet on inflation because you don’t get any payoff if you’re right about deflation.

- That’s all for today. Stop by our *new* website at https://enduringinvestments.com and let us know what you think. It needed a facelift! Good luck out there.

I think the key point this month is the point I made up top: we always need to be wary of one month’s data from any economic release. It’s important to remember that the release isn’t the actual situation, it’s a measurement of the actual situation and any measurement has a margin for error. All of these data need to be viewed through the lens of ‘does this change my null hypothesis of what was happening,’ and if the error bars are large enough then the answer almost always should be ‘no.’

However, markets don’t usually act like that. Although there’s not a lot of information in the economic data these days the markets act like there is. (I was, however, pleased to see the TIPS market not overreacting for a change.) Let’s look at this data for what it is: right now, the one thing we know for sure is that it’s hard to buy anything at all. Economic activity is a fraction of what it was before the lockdowns took effect – but that affects economic quantities transacted (GDP), not prices. We need to get back to something like normal business before we know where prices are going to reach equilibrium. From these levels, my answer is that in most cases the equilibrium will almost assuredly be higher. I think most consumer-to-consumer services are going to end up being a lot more labor-intensive, which is good for labor’s share of national income but bad for prices: declining productivity shows up in higher prices. And there’s lots more money out in the system. While some of this is because companies drew quickly on their bank lines lest those lines be pulled like they were in 2008-2009, a great deal of it is because the government is spending enormous sums (a lot of it helicopter money) and the Fed is financing that by buying the debt being issued. So while M2 growth probably won’t end up at 20% y/y for a long period, I think the best we can hope for is that it goes flat. That is, I think the money is here to stay.

Monetary velocity is falling, and in fact the next print or two are going to be incredibly low. Precautionary cash balances ballooned. But once the economy opens again, those precautionary balances will drop back to normal-ish and the money will still be there. It’s a cocktail for higher inflation, to be sure. The only question is how much higher.

Over the next few months, the inflation numbers will be hard to interpret. What’s temporary, and what’s permanent? Keep in mind that inflation is a rate of change. So hotel prices have plunged. Gasoline prices have plunged. But unless they continue to plunge, you don’t have deflation. You have a one-off that will wash out of the data eventually. If hotel prices retrace half of their plunge, that will be represented by a m/m increase from these levels. Airfares will end up higher than they were before the crisis, but even if they didn’t they’d likely be higher from here. The real question is whether the one-offs spread much farther than apparel/airfares/lodging away from home. So far, they’ve spread a little, but not a lot. We’re nowhere close to deflation, and I don’t think we’re going to be.