Summary of My Post-CPI Tweets (June 2019)

Below is a summary of my post-CPI tweets. You can (and should!) follow me @inflation_guy. Or, sign up for email updates to my occasional articles here. Investors with interests in this area be sure to stop by Enduring Investments or Enduring Intellectual Properties. Plus…buy my book about money and inflation. The title of the book is What’s Wrong with Money? The Biggest Bubble of All; order from Amazon here.

- OK, CPI day at last. We get to find out if Powell meant “transitory” in the one-month sense (probably not) or in the 3-6 month sense (more likely).

- After all we have had three weak core CPI figures in a row: 0.110% for Feb, 0.148% in March, 0.138% in April. Three 0.1%s, rounded.

- Last month the culprit was used cars, -1.3% m/m, and Apparel at -0.8% m/m, the latter due to a methodology change. These are both short-term transitory, probably.

- Meanwhile, the evidence that core is being infected these last three months by tail events is in the median CPI, which was +0.26%, +0.27%, and +0.20% the last 3 months.

- Housing, on the other hand, remains strong, and this should continue for a bit; Medical Care remains weak with pharma especially (+0.1% y/y)…and I think that is “longer-term transitory” that should start to retrace higher.

- I am expecting a return to normalcy, not so much a rebound, in autos and apparel. But that should be enough to hit the consensus figures of 0.21% on core, 2.09% y/y.

- Longer-term, the fact that interest rates have fallen so far suggests that the small rebound we have seen over the last year and a half in money velocity may have trouble extending.

- So I think Median probably peaks late this year or early next, though I don’t expect it to fall off a cliff, either, in this recession.

- Grabbing coffee. Back in 11 minutes.

- So maybe a liiiiiittle more transitory than we thought! Core +0.11% m/m, +2.00% y/y.

- Last 12 months. The comp is easier next month, but none of the last 4 months would have exceeded it anyway!

- Apparel basically flat m/m, which is approximately what I expected…-3.06% y/y though, which includes the methodology change.

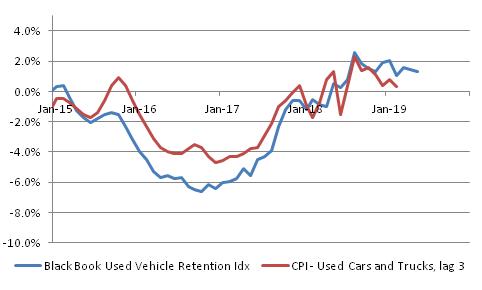

- CPI-Used Cars and Trucks was again down sharply m/m. -1.38%. That’s unlikely. Pushes y/y to +0.28%, Black Book has it about 1% above that.

- Housing: OER +0.26% m/m, Primary Rents +0.24%. Actually those aren’t far from the trends (y/y in each case declined a couple of hundredths, to 3.34% and 3.73% respectively), but last month had been chippier.

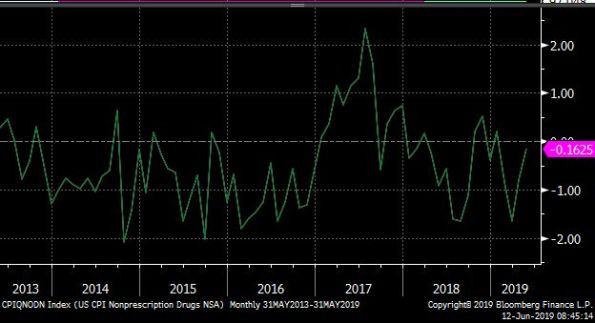

- Medical Care (and then I’m going to take a few minutes and dig deeper on some of these)…Medicinal Drugs (pharma) went into deflation. -0.11% m/m, -0.82% y/y. Chart in a moment. Doctor’s Services roughly unch, but only 0.30% y/y. Hospital Services bounced a bit, 1.30% y/y.

- Even with the bounce, Hospital Services is lower than two months ago, 3 months ago, etc. One year ago it was 4.70% y/y. Hospital Services is the largest component of the Medical Care subindex.

- Here is the y/y chart for drugs. Now, it’s very hard to measure this because there is tremendous dispersion in consumer costs for prescription drugs…massive differences based on which outlet, formulary, insurance, etc you have. Doing a lot of work on this. Sooo…

- this is the y/y picture for NONprescription drugs, which are much easier to measure. Basically no chg. So either prescriptn drug mkt is getting much more competitive (I doubt it), there is some change in collection method (possible), or a shift showing up as change.

- there is no lower-level index for drugs so we can’t really dig any deeper on that unfortunately. But it’s significant, not only for the CPI of course but for consumers generally (and the budget deficit) if health care costs really ARE slowing in a permanent way.

- CPI – College Tuition and Fees, essentially unch at 3.81% vs 3.86% y/y. But well off the lows.

- Now what does that last picture look like…oh, yeah, the S&P Target Tuition Inflation Index (my baby).

- Core inflation ex-housing down to 1.04%, the lowest level since February 2018. Still nowhere near the lows, nowhere near deflation, and with lots of transitory stuff in it.

- Core goods prices still in deflation, -0.2%. But lagged effect of the dollar’s 2017 selloff should just now be starting to wash into the core goods data. And we still haven’t seen the tariff effect yet. So this is still to come and the reason I don’t think we’ve peaked yet.

- WEIRD: Biggest declines on the month were used cars & trucks (-15.3% annualized), Leased cars & trucks (-13.8%). Biggest gainers: Car and Truck Rental (+26.5%), Public Transportation (+24.8%).

- Early estimate for Median CPI is +0.21% m/m, making y/y 2.81%. So, again, it’s a tails story.

- Sorry, didn’t calculate the sheet for y/y. Should be 2.76% y/y for median, down from 2.80%.

- Here is m/m Median CPI. Notice there’s really no major slowdown here. It’s been pretty steady and rising slightly y/y for a while. Nothing below 0.2% m/m since last August.

- OK, four pieces and then we’ll sum up. Piece 1 is food and energy.

- Piece 2 is core goods. As I said, I expect this to turn back higher. This is where you find Used Cars and Apparel…so transitory stuff is big here. This is also where tariffs fall heaviest.

- Piece 3 is Core Services less Rent of Shelter. Same story here: “What is up with medical care?” It may be that since consumers under the ACA end up paying out of pocket for a much larger share, they’re bargaining harder. That could be why it feels so much worse than this.

- Finally, rent of shelter – same old same old. No deflation while this remains steady as a rock.

- So, in sum. I do think that Powell is right in focusing on the “transitory” inflation slowdown. Better measures, such as Median (see below for Median vs core), show no significant slowdown yet.

- …and it’s hard to see where a slowdown would come from. Medical Care is already very slow. Core goods is already very slow, with negative tails already in the data but not much sign yet of the tariff effect sure to come. Housing is solid.

- So for now, I expect median inflation to continue to crawl higher. As we get later in the year, though, unless interest rates rebound a lot higher there’s a decent chance that money velocity droops again.

- Now, money velocity is already REALLY low so it may not. This chart isn’t our best model but it suggests velocity is already too low for the level of int rates (I’m not sure it’s a linear function near zero though). It was responding, but lower int rates may truncate a bounce.

- OK that’s all for today folks. Visit us at http://www.enduringinvestments.com if you want to have a more private chat. Thanks for tuning in!

Nothing more really to add – I will say that although Powell is right and these are transitory factors, I have lost faith that the Chairman is a “different sort” of Fed Chair since he doesn’t have an academic background. He was at first, but appears to have been captured by the econocognoscenti. Ergo, I expect the Fed will ignore the fact that inflation is still drifting higher, and start to cut rates as the growth figures make it ever clearer that the economy is heading towards (if not already in) recession. Long-end yields are already 110bps or more off the highs, so I think the bond market already has more than half its recession-rally finished (I don’t think we’ll have new low yields this cycle since I don’t think inflation will collapse and I don’t think the recession will be as bad). But stocks haven’t even begun their earnings-recession selloff, so…